idaho sales tax rate in 2015

We strongly recommend using a sales tax calculator to determine the exact sales tax amount for your location. Tax rate may be adjusted annually according to a formula based on balances in the.

States With Highest And Lowest Sales Tax Rates

L Local Sales Tax Rate.

. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. The average local rate is 003.

Find your pretax deductions including 401K flexible account contributions. The use tax rate is the same as the sales tax rate. How to Calculate 2015 Idaho State Income Tax by Using State Income Tax Table.

There are a total of 124 local tax jurisdictions across the state collecting an average local tax of 0. Find your gross income. ID State Sales Tax Rate.

The Idaho ID state sales tax rate is currently 6 ranking 16th-highest in the US. What is Idahos local sales tax rate. Calculate By Tax Rate or calculate by zip code.

Contact the following cities directly for questions about their local sales. 278 rows Idaho Sales Tax. The tax data is broken down by zip code and additional locality information location population etc is also included.

Depending on local municipalities the total tax rate can be as high as 9. Accuracy cannot be guaranteed at all times. S Idaho State Sales Tax Rate 6 c County Sales Tax Rate.

Local level non-property taxes are allowed within resort cities if approved by 60 majority vote. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3. Object Moved This document may be found here.

Depending on local municipalities the total tax rate can be as high as 9. ID Combined State Local Sales Tax Rate avg 604. Sales Tax Rate s c l sr.

The Idaho ID state sales tax rate is currently 6. Average Sales Tax With Local. The Idaho ID state sales tax rate is currently 6.

With local taxes the total. Prescription Drugs are exempt from the Idaho sales tax. There are a total of 124 local tax jurisdictions across the state.

While many other states allow counties and other localities to collect a local option sales tax Idaho does not permit local sales taxes to be collected. Calculate By ZIP Code or manually enter sales. The sales tax rate in Idaho for tax year 2015 was 6 percent.

Enter zip code of the sale location or the sales tax rate in percent Sales Tax. So whilst the Sales Tax Rate in Idaho is 6 you can actually pay anywhere between 6 and 9 depending on the local sales tax rate applied in the municipality. Some Idaho resort cities have a local sales tax in addition to the state sales tax.

The Idaho State Sales Tax is collected by the merchant on all qualifying sales made within Idaho State. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. The average combined tax rate is 603 ranking 37th in the.

What is Idahos local sales tax rate. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax. Find your income exemptions.

The table below summarizes sales. Check the 2015 Idaho state tax rate and the rules to calculate state income tax. A sample of the 317 Idaho state sales tax rates in our database is provided below.

Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3. The current Idaho sales tax rate is 6. Our dataset includes all local sales tax jurisdictions in Idaho at state county city and district levels.

Sr Special Sales Tax Rate. The Idaho State Tax Tables for 2015 displayed on this page are provided in support of the 2015 US Tax Calculator and the dedicated 2015 Idaho State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Sales tax rates are subject to change periodically.

There are a total of 112 local tax jurisdictions across the state collecting an average local tax of 0074. Cities with local sales taxes. This includes hotel liquor and sales taxes.

Depending on local municipalities the total tax rate can be as high as 9. 31 rows The state sales tax rate in Idaho is 6000. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

The Idaho Department of Revenue is responsible for publishing the latest Idaho State. These local sales taxes are sometimes also referred to as local option taxes because the taxes are decided by the voters in the community affected.

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

How High Are Cell Phone Taxes In Your State Tax Foundation

Littourati Main Page Blue Highways Moscow Idaho Idaho County Idaho Travel Idaho Adventure

Historical Idaho Tax Policy Information Ballotpedia

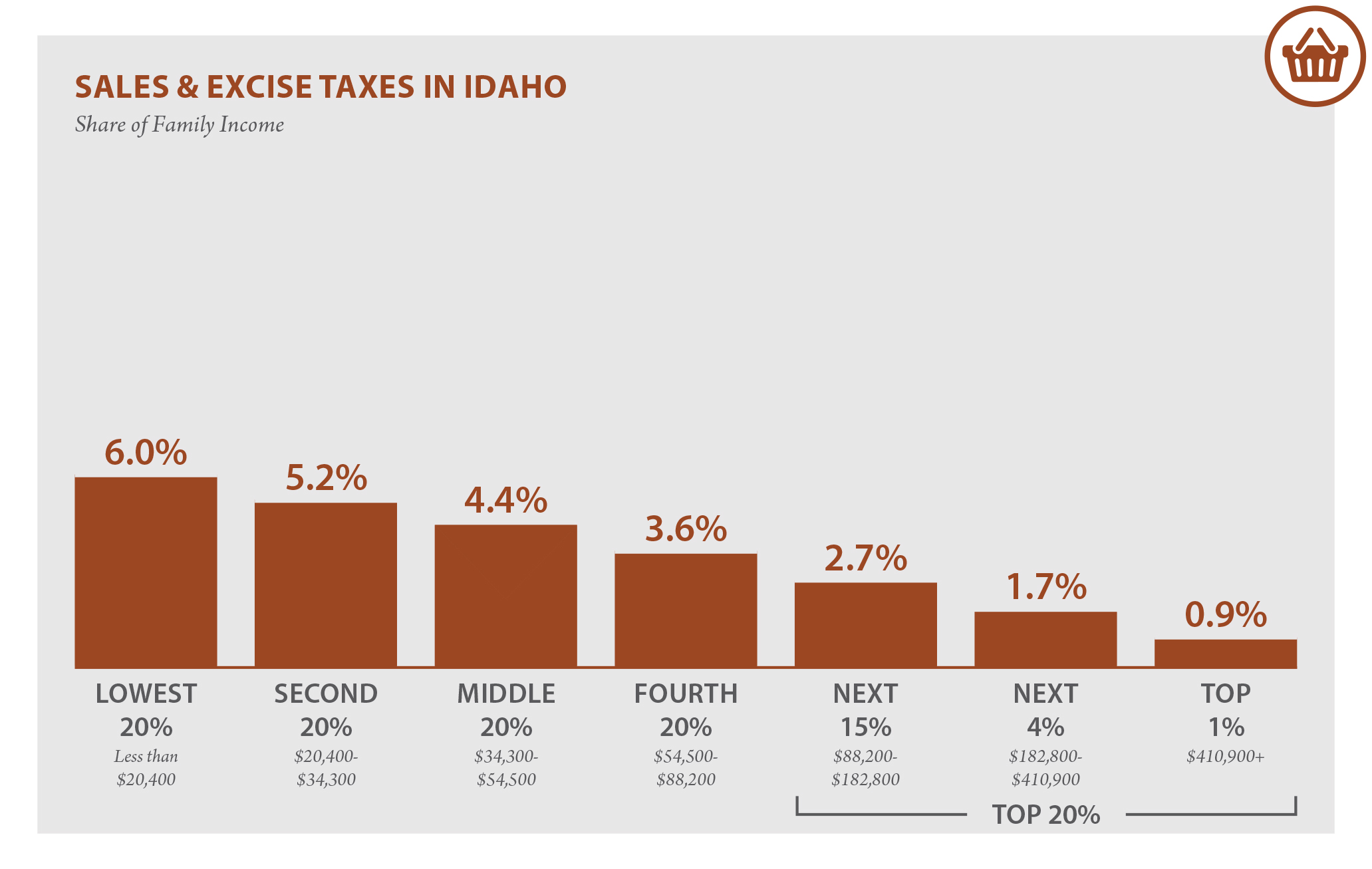

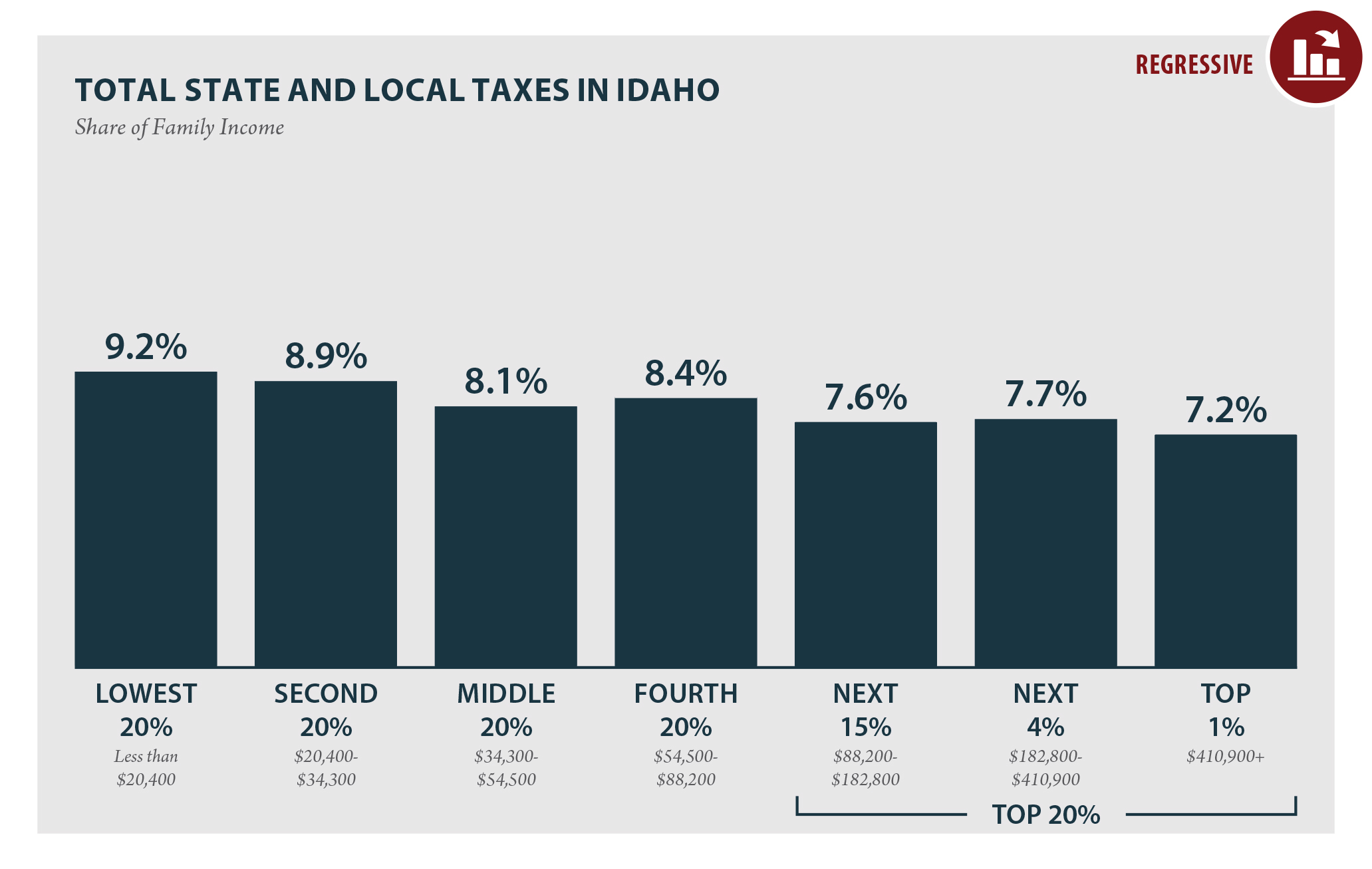

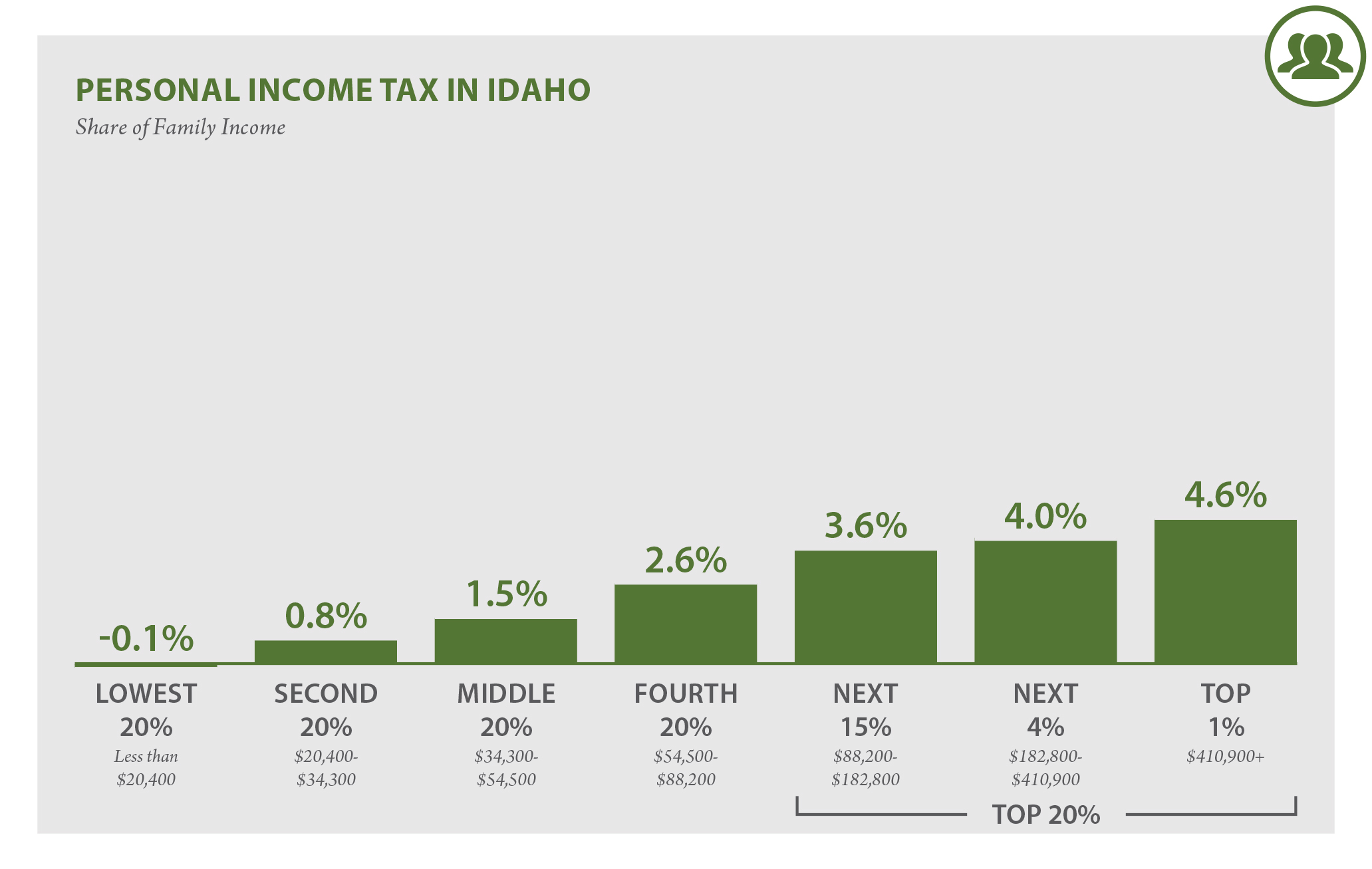

Idaho Who Pays 6th Edition Itep

Idaho Who Pays 6th Edition Itep

Idaho Who Pays 6th Edition Itep

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Combined State And Local General Sales Tax Rates Download Table

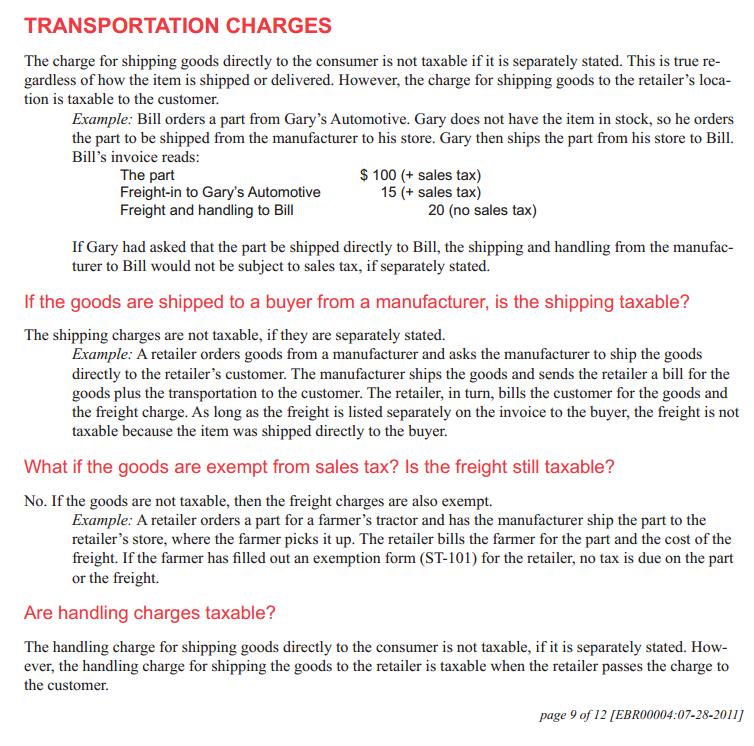

Is Shipping Taxable In Idaho Taxjar

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Economic Nexus Laws By State Taxconnex

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio